Deep Dive into the 2025 United Van Lines Movers Study: Oregon's #1 Inbound Ranking and Its Implications for Oregon 2025 Inbound Migration

- Christian Bryant

- Jan 9

- 4 min read

Hey everyone, it's Christian Bryant here—your go-to Mr. Portland Landlord—diving headfirst into some data that's got the whole Oregon real estate community buzzing, the Oregon 2025 inbound migration study. The 2025 United Van Lines National Movers Study, released at the end of December 2025, crowned Oregon as the top inbound state in the nation for the first time ever, with a staggering 64.5% to 65% of tracked household moves coming INTO the state. If you're a landlord, property manager, or investor anywhere from Portland down to Medford, this isn't just interesting trivia—it's a roadmap for where rental demand is heading, where vacancies might tighten (or not), and where the smartest investment dollars could flow in the coming years. I've pored over the full study, the press kit, the interactive map, and cross-referenced it with recent housing reports to give you a comprehensive reference point. Let's break it down step by step, with all the key numbers, trends, and real-talk implications.

First, a quick national context to set the stage. United Van Lines has been tracking this since 1977, basing rankings on household moves handled by their UniGroup network across the 48 contiguous states and D.C. States with 55%+ inbound are "high inbound," 55%+ outbound are "high outbound," and the rest are balanced. For 2025, the big national drivers for moving were: closer to family (29.13%), new job or company transfer (25.92%), retirement (13.86%), lifestyle change (9.54%), and improved cost of living (a tiny 3.22%). Looking at the eight-year trends, job transfers have plummeted from 47.6% in 2018 to under 26% now—folks aren't chasing corporate relocations like they used to. Instead, family and lifestyle are climbing steadily. It's a shift toward smaller cities and a "different pace of life," as United's VP Eily Cummings put it.

Now, onto Oregon—the Beaver State stole the show with 64.5% inbound (1,188 inbound out of 1,842 total moves tracked). That's a huge jump from #8 inbound in 2024. We edged out West Virginia (62.1%), South Carolina (60.8%), Delaware (59.7%), and Minnesota (58.2%). Outbound? Only 35.5%, nowhere near the top outbound states like New Jersey (62% outbound for the eighth straight year).

Why Are People Flocking to Oregon?

The study breaks down reasons by state for inbound moves, and Oregon shines in two big categories:

New Job/Company Transfer: Oregon ranked 7th nationally with 36.1% of inbound movers citing this. Tech and healthcare are the magnets—growing opportunities in software, semiconductors, and expanding medical networks, especially in the Willamette Valley.

Lifestyle Change: We came in 3rd nationally at 15.7%. Think outdoor recreation, craft beer scene, farm-to-table living, and that quirky Pacific Northwest charm. (Hey, not everyone minds a little rain if it keeps the greenery lush, right?)

Closer to family ranked lower for us, retirement even less so (we're not Florida yet), and cost of living barely registered—Oregon didn't crack the top 10 for that category. Outbound movers from Oregon? Mostly retirees heading warmer or families reuniting elsewhere.

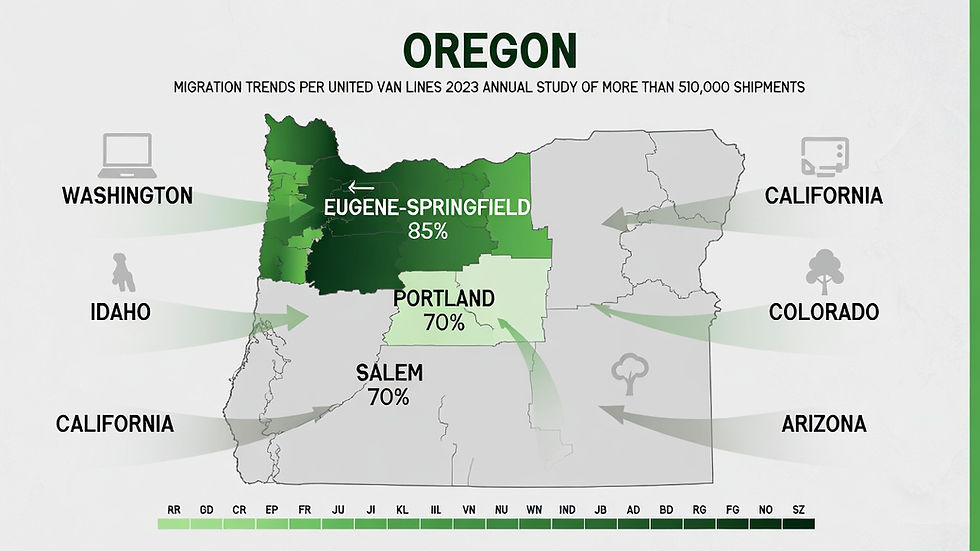

Where Is the Growth Landing in Oregon?

This is where it gets exciting for us locals—the growth isn't uniform; it's concentrating in secondary metros.

Portland didn't make the top 25 inbound MSAs, suggesting more balanced flows there—still net positive statewide, but the explosive one-way traffic is south and mid-state. Bend, Medford, and coastal areas show anecdotal gains from remote workers and lifestyle seekers, though not quantified in the top lists.

Can Oregon Sustain This If It Continues?

Short answer: we'd love the demand, but infrastructure is already groaning. Oregon's natural birth rate is below national average, so inbound migration is the primary population driver—especially in metros. Recent estimates (as of early 2026) show statewide population growth rebounding slightly after post-pandemic dips, but we're still short on housing. Multifamily permits dropped 33% from 2021 peaks, and projections estimate we need hundreds of thousands more units by 2040 to keep up with household formation. Roads, schools, water systems in places like Eugene and Salem are feeling it. Continued surge without ramped-up development could mean even tighter inventory, higher rents long-term, and more legislative scrutiny (rent caps, inclusionary zoning, impact fees—you know the drill).

Recent rental market snapshots (late 2025): statewide vacancy climbed to around 6.2%, Portland metro ~5.5%, with rents dipping 1-1.3% YoY in some areas due to new completions. But supply is projected to tighten again in 2026-2027 as completions slow. If inbound keeps pace, expect vacancies to compress and rents to stabilize or climb, especially in Eugene, Salem, and emerging spots.

What This Means for Oregon Landlords, Property Managers, and Investors

For rentals: Strong inbound = sustained demand. Job-driven movers (tech/healthcare) often have solid incomes and credit—prime tenants. Lifestyle folks prioritize amenities like trails, modern kitchens, energy efficiency. Focus upgrades there, and you'll rent faster. Vacancies should stay low in secondary markets; Portland might see more competition from new builds short-term.

For investors and developers: Golden opportunities in Eugene-Springfield, Salem, and mid-Valley duplexes/multifamily/ADUs. Appreciation potential high with population pressure. But watch construction costs and regs—Oregon's housing shortage persists, with projections needing 250,000+ units by 2035. Multifamily outlook for 2026: cooling supply could mean accelerating rent growth if demand holds.

Risks? Overbuilding in hot spots could spike vacancies temporarily, and growth pains might bring more tenant-friendly laws. Stay educated, network, and diversify.

This study is a solid vote of confidence in Oregon's desirability. If you're positioning for the next cycle, secondary markets look primed.

(And to all the new arrivals: Welcome! Just remember, layers are your friend, and coffee is a food group here.)

Sources

United Van Lines 2025 National Movers Study Full Report and Interactive Map: https://www.unitedvanlines.com/newsroom/2025-national-movers-study

United Van Lines Press Release (Dec 29, 2025): https://www.prnewswire.com/news-releases/united-van-lines-49th-annual-movers-study-reveals-family-jobs-and-retirement-are-factors-reshaping-interstate-migration-in-the-us-302649776.html

OregonLive Coverage (Jan 2026): https://www.oregonlive.com/business/2026/01/oregon-tops-nationwide-list-for-inbound-movers-is-population-growth-on-the-rebound.html

Multifamily NW Survey (Oct 2025) on Vacancies/Rents: https://djcoregon.com/news/2025/10/17/oregon-multifamily-rents-vacancy-2025-survey/

Common Sense Institute Oregon Housing Report (2025): https://www.commonsenseinstituteus.org/oregon/research/housing-and-our-community/oregons-housing-shortage

.png)

Comments