Common Rental Scams in Oregon: An In-Depth Guide for Landlords and Tenants

- Christian Bryant

- Oct 15

- 7 min read

Oregon's rental market remains one of the most competitive in the nation, with cities like Portland and Eugene experiencing chronic housing shortages that push average rents to over $1,800 per month in urban areas as of 2025. This environment, compounded by an affordable housing crisis, has fueled a surge in rental scams, costing Americans more than $145 million in real estate and rental fraud in 2023 alone, according to the FBI's Internet Crime Complaint Center. By 2024, overall fraud losses reported to the FTC reached $12.5 billion, a 25% increase from the previous year, with imposter scams (often overlapping with rental fraud) accounting for $2.95 billion.

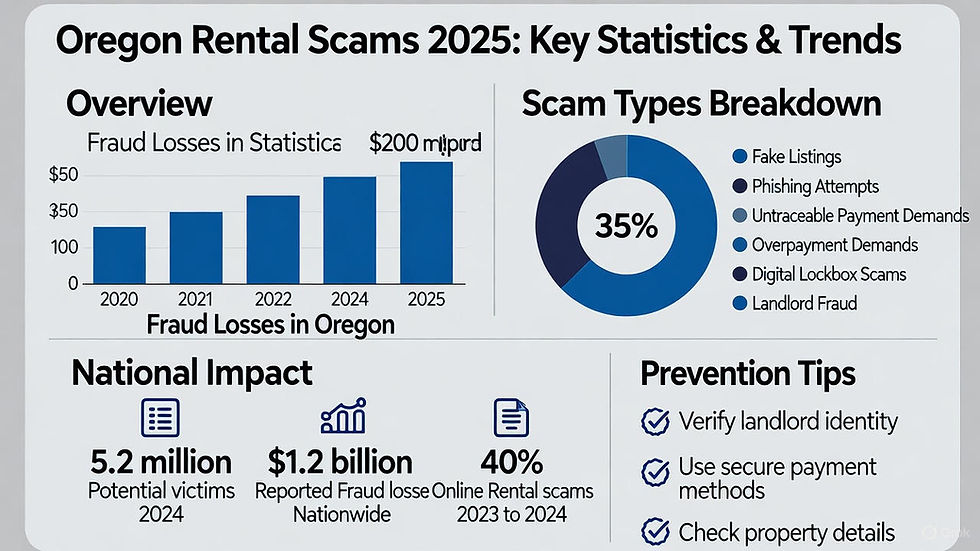

In Oregon specifically, fraud cases per 100,000 residents ranked the state 23rd lowest nationally in 2024, but direct reported losses exceeded $200 million, highlighting the growing threat amid the state's housing woes. Consumer complaints to the Oregon Department of Justice nearly doubled in 2024, with scams involving impersonation and fraudulent transactions topping the list.

Looking ahead to 2025, projections indicate a continued escalation in fraud, driven by economic downturns, AI-enhanced scams, and persistent housing shortages. Oregon is forecasted to face $201 million in reported fraud losses and an estimated $1.2 billion in unreported losses, totaling $1.4 billion, according to the Common Sense Institute. Real estate fraud, including rental scams, is projected to account for approximately $41 million of these losses. Nationally, rental scams are expected to affect 5.2 million Americans in 2025, with a 64% increase in reported cases as per FBI data, and experts predict a "snowball" effect due to anticipated recessions amplifying fraudulent tenant applications and listings. Oregon's aging population exacerbates this, with seniors (projected to comprise 1 in 5 residents by 2029) facing a fourfold increase in high-value scam losses from 2020-2024, and emerging as the fastest-growing segment of the unhoused due to fixed incomes clashing with rising rents.

This expanded guide delves deeper into the mechanics of common scams targeting tenants and landlords in Oregon's rental industry. We'll break down how each scam operates step-by-step, incorporate relevant statistics and real-world examples, and provide comprehensive prevention strategies. Drawing from sources like the FTC, BBB, and local Oregon reports, this article aims to equip you with the knowledge to avoid these pitfalls.

Scams Targeting Landlords

Landlords face rising fraud, with 70% reporting increases in fake applications amid Oregon's eviction moratorium extensions through 2024. Eviction cases hit record highs in 2023 (over 13,000 permits issued by November 2024), and 2025 projections suggest fraud will "snowball" due to economic pressures, with internal and tenant fraud rising.

1. Fake Tenant Applications and Identity Theft

Detailed Explanation and How It Works: Step-by-step:

Scammers forge documents: fake pay stubs (e.g., using Photoshop), stolen SSNs, or bogus references.

They apply, often rushing the process to exploit incentives like rent specials.

Once approved, they occupy, pay minimally, then default, delaying eviction via Oregon's 90-day notice laws.

Losses include unpaid rent (average $5,000-10,000) and property damage.

Statistics: Application fraud up 70%; in Oregon, related to broader fraud losses of $200M in 2024. For 2025, experts predict exploding fraud rates, with detection dropping from 90% to 75% pre-pandemic levels, and internal fraud risks growing amid falling rents.

Expanded Tips for Landlords to Protect Themselves:

Use verified screening companies; call employers/references directly.

Check for inconsistencies

2. Overpayment Scams

Detailed Explanation and How It Works: Step-by-step:

"Tenant" sends a check exceeding the deposit/rent (e.g., $3,000 for $2,000 due).

They request a refund for the overage, citing an "error."

Landlord cashes and refunds; original check bounces, leaving a net loss.

Statistics: Common in imposter scams, contributing to $2.95B losses in 2024. Expected to rise in 2025 with overall fraud projections.

Expanded Tips for Landlords to Protect Themselves:

Wait until funds clear bank account (10-14 days); prefer electronic transfers.

Ask your bank to do a "verification of funds" before deposit

Scams Targeting Tenants

Tenants, often under pressure from Oregon's low vacancy rates (around 4-5% in major cities in 2025), are prime targets. Rental scams have seen a sharp rise, with over 70% of major apartment landlords reporting increased fraudulent activity in recent years. In 2025, experts estimate a 43% chance of renters encountering fake listings during their search, with 5.2 million national victims projected and median losses of $1,000 per incident. Oregon's seniors are particularly vulnerable, with rising AI-driven impersonation scams contributing to a projected increase in housing-related fraud.

1. Fake or Hijacked Rental Listings

Detailed Explanation and How It Works: This is one of the most prevalent scams, often starting on platforms like Craigslist, Facebook Marketplace, or even legitimate sites like Zillow. Scammers exploit Oregon's self-guided tour trend, enabled by digital lockboxes, which surged during the pandemic and contributed to a spike in fraud.

Step-by-step:

Scammers scour legitimate listings on sites like Zillow or Apartments.com, copying high-quality photos, detailed descriptions, and addresses of real properties.

They alter key details, such as contact information (e.g., replacing the real agent's email with their own) or slashing the rent price by 30-50% below market value to create urgency—e.g., advertising a $2,000 Portland apartment for $1,200.

The fake ad is reposted on free or less-moderated platforms, sometimes using stolen identities to appear credible (as in a 2025 Portland case where a scammer in Uganda hijacked a local man's identity to post dozens of phony rentals nationwide).

When a tenant inquires, the scammer poses as the landlord or agent, often claiming to be "out of town" or overseas, providing excuses to avoid in-person meetings.

They request upfront payments for application fees ($50-100), security deposits, or first/last month's rent via untraceable methods.

In advanced versions, scammers obtain temporary access codes for self-guided tours by posing as legitimate prospects to real agents, then guide victims remotely while collecting funds.

After payment, the scammer ghosts the victim, who arrives to find the property unavailable or occupied, resulting in losses averaging $1,000-3,000 per incident.

Statistics: Nationally, real estate scams led to $145 million in losses in 2023, with rental fraud comprising a significant portion; in 2024, FTC reports indicate a continued upward trend amid broader fraud increases. In Oregon, cases like those in Eugene highlight how affordable housing shortages amplify this, with local news reporting multiple victims losing deposits in 2024-2025. Projections for 2025 show a 64% rise in reported rental scams nationally, with Oregon's real estate fraud estimated at $41 million, potentially higher due to unreported cases.

Expanded Tips for Tenants to Protect Themselves:

Reverse-search images from the listing using Google Images to check for duplicates on other sites.

Verify ownership through Oregon county assessor databases (e.g., Multnomah County Property Records) or the Oregon Secretary of State's business registry for management companies.

Insist on an in-person or verified virtual tour; if self-guided, confirm the lockbox code directly with the listed agency.

Compare rents using tools like Zillow's Rent Index or HUD's Fair Market Rents for Oregon (2025 data shows Portland one-bedroom averages $1,600). If something seems too good to be true, it probably is.

Avoid ads with generic descriptions or stock photos; legitimate ones include specific details like utility inclusions per Oregon's rental laws.

Report to the FTC at reportfraud.ftc.gov and Oregon DOJ at 1-877-877-9392; in 2024, such reports helped recover funds in cases like the FTC's $1.9 million refunds for fake ads.

2. Phishing for Personal Information

Detailed Explanation and How It Works: This scam focuses on identity theft, often intertwined with fake listings. Step-by-step:

Scammers create or hijack a listing and encourage quick applications.

They request excessive personal data early—SSN, bank statements, driver's license—under pretexts like "pre-screening" or "background checks."

Victims submit via email or fake forms, sometimes paying a fee.

The data is sold on the dark web or used for further fraud, like opening credit lines or filing fake tax returns.

In roommate scams, common on social media in college towns like Eugene, scammers pose as ideal roommates to extract info.

Statistics: Identity theft tied to scams contributed to $12.5 billion in total fraud losses in 2024, with older adults seeing a fourfold increase in high-value losses ($10,000+) from 2020-2024. Oregon's $200 million in fraud losses in 2024 includes many identity-related cases, with 2025 projections estimating $1.4 billion total losses statewide.

Expanded Tips for Tenants to Protect Themselves:

Only share sensitive info after signing a lease and verifying the landlord via public records.

Use FCRA-compliant services like MyRental or TransUnion for screenings.

Monitor credit reports annually via annualcreditreport.com and place fraud alerts if suspicious.

Consult Oregon resources like Tenant advocacy groups for safe application guides.

3. Untraceable Payment Demands

Detailed Explanation and How It Works: Often the culmination of other scams. Step-by-step:

After building trust via fake listings or tours, scammers demand immediate payment to "hold" the property.

They specify irreversible methods: wire transfers, gift cards, crypto, or apps like Zelle/Venmo.

Victims send funds (median loss $1,500 per FTC data), only to be ghosted.

Statistics: In 2024, bank transfers and crypto accounted for more losses than other methods combined in FTC reports. For 2025, with a projected 64% rise in rental scams, losses are expected to increase, particularly in high-demand areas like Oregon.

Expanded Tips for Tenants to Protect Themselves:

Pay only via check, credit card, or secure portals like Cozy or AppFolio.

Never pay without a signed rental agreement;

If scammed, report immediately to your bank and ic3.gov for potential recovery.

Oregon-Specific Considerations

Oregon's SB 608 (rent caps at 7% + CPI) and eviction protections make it attractive for scammers. In 2024, a Multnomah County case saw $260,000 in fraudulent rent assistance claims. For 2025, with $41 million in projected real estate fraud and seniors facing heightened risks, report to Oregon DOJ; seek aid from Legal Aid Services of Oregon .

Conclusion

With fraud losses soaring, vigilance is essential. Document all interactions and report suspicions promptly to curb these crimes.

References

FTC: Rental Listing Scams

Oregon DOJ: Top Complaints 2024

FTC Data: Fraud Losses 2024

Common Sense Institute: Oregon Fraud 2025

Proof: Rental Property Fraud

ScamWatchHQ: Rental Scams 2025

OregonLive: Portland Identity Scam

NBC16: Eugene Rental Warnings

Buildium: 2025 Rental Predictions

OregonLive: Eviction Trends

OregonLive: Rent Assistance Fraud

Cloaked: Rental Scams 2025

Snappt: Tenant Fraud Statistics 2025

.png)

Comments