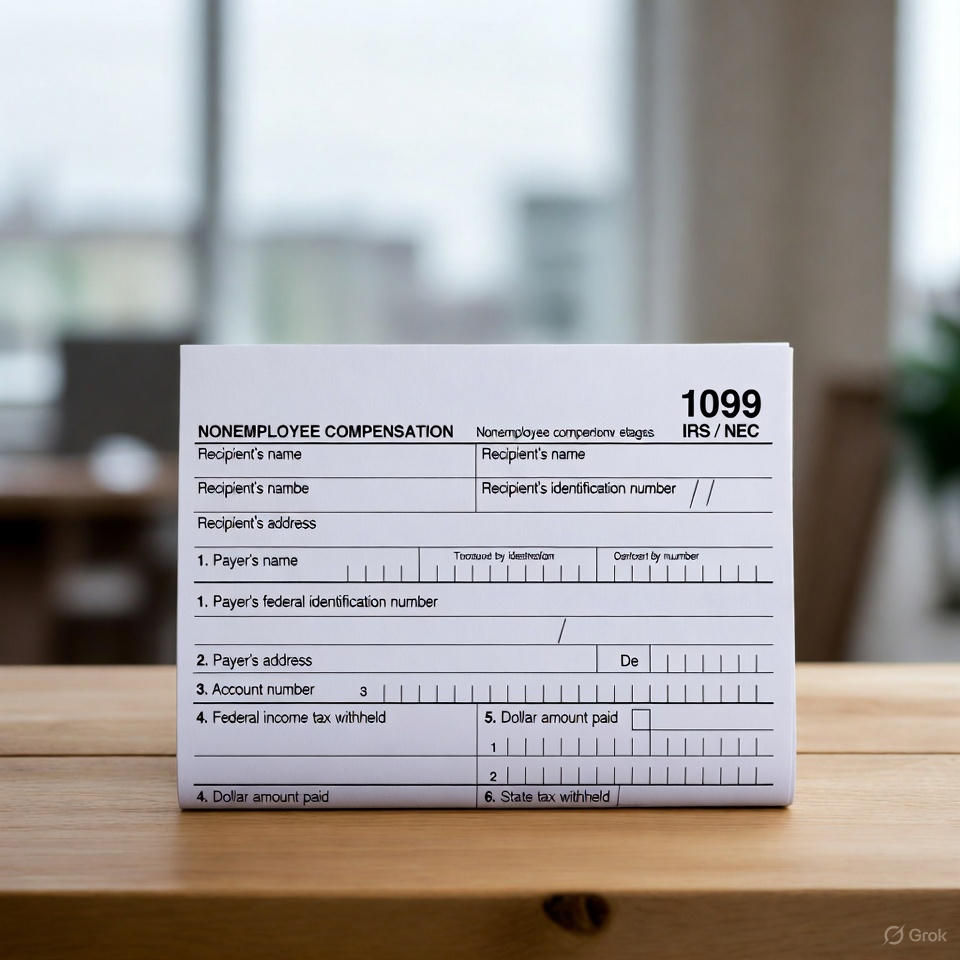

January Deadline Alert: 1099-NEC Requirements for Oregon Landlords – Avoid IRS Penalties in 2026

- Jan 7

- 5 min read

Hey there, fellow Oregon landlords and property managers – it's January 7, 2026, and if you're like me, you're probably still recovering from the holidays while gearing up for tax season. But before you dive into those Schedule E deductions for your rental properties, there's one federal requirement that sneaks up on a lot of us every year: issuing 1099-NEC forms to contractors. Miss it, and the IRS can hit you with penalties that start small but add up fast. Trust me, I've seen too many good landlords get caught off-guard by this, scratching their heads wondering why they owe extra when they were just trying to keep their rentals in tip-top shape.

Paying that trusty handyman, plumber, electrician, or landscaper for repairs and maintenance is part of the game in our Portland metro and statewide Oregon rental world. If you paid any unincorporated contractor $600 or more in 2025 for services (not just materials), the IRS wants you to report it on a Form 1099-NEC. It's not complicated once you make it a habit, and honestly, it's one of those proactive steps that protects you from bigger headaches down the road, like audits or disputes. Plus, it builds solid relationships with your go-to vendors – they appreciate getting their tax info on time.

Why 1099-NEC Requirements Matter for Oregon Rental Property Owners

1099-NEC Requirements for Oregon Landlords? This is purely a federal thing – no Oregon state income tax twist here, though we always recommend checking with your accountant for any local nuances. The rule is simple: if those payments were for services in the course of your rental business (think roof repairs, plumbing fixes, painting, or yard work), and they hit that $600 threshold in total for the year, you need to issue a 1099-NEC. It's the IRS's way of making sure everyone reports income properly.

A quick real-world example: Say you hired a local roofer to patch leaks on a couple of your Portland rentals, and the bill came to $1,200. That's a clear 1099-NEC situation. On the flip side, if you just bought supplies from Home Depot or paid a big corporation like a national plumbing chain, you're usually off the hook – payments to corporations are generally exempt, and pure merchandise doesn't count.

The big urgency right now? You've got until January 31, 2026, to furnish copies to your contractors and file with the IRS. (If you're filing 10 or more information returns total, you must e-file.) Nobody wants to start the year with penalties, right? They can range from $60 per form if you're just a bit late, up to $330 or more if it's later – and for intentional disregard, even higher with no cap. Ouch. But here's the good news: getting ahead of this is straightforward and prevents all that stress.

Proactive Habits: Collect W-9 Forms from Contractors Year-Round

Remember how we talked in past articles about screening tenants thoroughly from the first showing? Same idea here – start early with contractors. Whenever you hire someone new (or even a regular), have them fill out a Form W-9 right away. It gives you their Taxpayer ID Number (TIN), name, and address, so you're not scrambling in January. Make it part of your invoice approval process. I've made this a standard at my operations, and it saves hours when tax time hits. Pro tip: Keep a folder (digital or physical) just for these – future you will thank present you.

Step-by-Step Guide to Handling 1099-NEC Requirements for Landlords

Alright, let's break it down like we're walking through a property showing:

Gather your records: Tally up all 2025 payments to each contractor. Use your accounting software, bank statements, or checkbook – anything over $600 in services triggers it.

Get the forms: Download free from the IRS website, buy pre-printed ones, or use online services like Tax1099.com or even payroll platforms that handle this.

Fill them out: Box 1 is for the total nonemployee compensation. Double-check the contractor's info from their W-9.

Send to recipients: Mail or electronically deliver Copy B to contractors by January 31. (They need it for their taxes!)

File with the IRS: Send Copy A with Form 1096 (transmittal summary) by January 31 if paper filing, or e-file directly.

If you're tech-savvy, services can automate most of this for a small fee – worth it if you have multiple contractors.

Common Mistakes Oregon Landlords Make (And How to Avoid Them)

I've heard stories from PAROA members: forgetting to include a late-year invoice that pushes someone over $600, using the old 1099-MISC by mistake, or not getting a TIN and facing backup withholding headaches. Or the classic – assuming "it's just a small job" means no reporting. Another one: reimbursing materials separately but lumping labor in. Stick to services only for the count.

And hey, a little humor to lighten it: Tax forms aren't as fun as finding a great tenant who pays on time and keeps the place spotless, but skipping them is like ignoring a leaky faucet – it starts small but can flood your wallet with penalties.

Quick Checklist for 1099-NEC Compliance

Reviewed 2025 payments?

Collected W-9s from all contractors?

Prepared and sent forms by Jan 31?

Filed with IRS (e-file if needed)?

Kept copies for your records (at least 4 years)?

Knock this out now, and you'll sleep better knowing you're compliant and professional.

Wrapping this up – staying on top of 1099-NEC requirements isn't just about avoiding penalties; it's about running your rental business like the pro you are. It ties right into those deductions you'll claim on Schedule E, keeps the IRS happy, and shows your contractors you mean business (in a good way).

As always, if you've got questions or need resources, reach out through PAROA – we're here to help Oregon landlords thrive.

Happy (and compliant) tax prepping!

Christian Bryant

For the Portland Area Rental Owners Association

Sharing insights with landlords, property managers, and real estate investors across the Portland metro and Oregon

Sources:

IRS Instructions for Forms 1099-MISC and 1099-NEC (2025): https://www.irs.gov/instructions/i1099mec

IRS Guide: Reporting Payments to Independent Contractors: https://www.irs.gov/businesses/small-businesses-self-employed/reporting-payments-to-independent-contractors

Nolo: Do Landlords Need to File Form 1099-NEC?: https://www.nolo.com/legal-encyclopedia/do-landlords-need-to-file-form-1099-nec.html

Avail: 1099 Requirements for Landlords and Rental Property Taxes: https://www.avail.co/education/articles/new-1099-requirements-for-landlords-and-rental-property-taxes

TenantCloud: The Complete 1099 Tax Form Guide for Landlords in 2025: https://www.tenantcloud.com/blog/the-complete-1099-tax-form-guide

Tax1099 Blog: 1099-NEC Filing Deadline 2026 Key Dates: https://www.tax1099.com/blog/1099-nec-filing-deadline-2026/

.png)

Comments